When the City of Seattle adopted a special tax on firearms and ammunition in the summer of 2015 in an effort to raise revenue to finance a “gun violence reduction” program, proponents projected an annual revenue of between $300,000 and $500,000.

History has proven them to have been disastrously wrong, with revenue data and body counts as evidence.

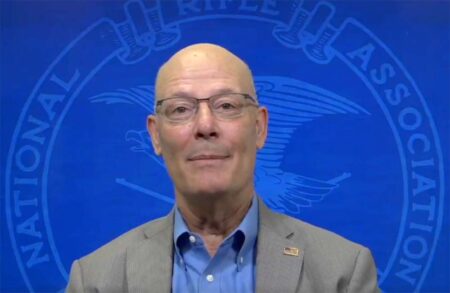

Critics, most notably the Citizens Committee for the Right to Keep and Bear Arms—the national grassroots gun rights organization based in nearby Bellevue—predicted revenue would never reach the revenue forecast. More importantly, CCRKBA Chairman Alan Gottlieb doubted the scheme would result in lower violent crime.

He was right on both accounts. According to new data from the City of Seattle, as of March 14, last year saw gun tax revenue totaling $113,021 for 2023. The tax, patterned after a gun/ammo tax in Cook County, Illinois, charges $25 for the sale of each firearm, 5 cents per each centerfire round and 2 cents per each rimfire cartridge. The tax was challenged in court by the National Rifle Association (NRA), National Shooting Sports Foundation (NSSF) and Second Amendment Foundation (SAF), but the state Supreme Court upheld the tax 8-1.

In 2016, the first full year of the tax collection, Seattle Police logged 20 homicides. Seven years later, the homicide body count for 2023 had tripled, even by the most conservative number of 64. Seattle Homicide—a popular account on “X” (formerly Twitter)—puts the number at 73. A reporter at the Seattle Times says the number is 69 because the death of an unborn infant whose mother was fatally shot in broad daylight wasn’t counted, and neither were deaths related to criminal attacks in 2022.

Indeed, since the tax was approved, revenue has never come close to the pie-in-the-sky forecast, while murder and violent crime have gone up. So far this year, according to “Seattle Homicide,” the city has logged 12 murders.

CCRKBA’s Gottlieb has called the tax and its purported purpose a “monumental failure.” In 2017, he called on the city to repeal the tax, labeling the plan a “colossally stupid idea.” Four years later, in 2021, Gottlieb issued a statement in which he described the gun tax as “nothing more than a snake oil sales pitch.”

“The gun tax was an outrage when it was adopted and now it is officially a disastrous failure,” Gottlieb observed at the time. “The tax literally drove business out of the city and into a neighboring county, resulting in a loss of revenue, and it’s pretty clear the actual intent was to push gun stores out and make it harder for Seattle residents to purchase firearms and ammunition. Obviously, when you do that, only criminals will be armed, and crime will go up.”

The NRA eventually called it “A textbook case on the law of inverse consequences.” The NSSF said it was a “predicted fail” that brought in pennies where dollars were anticipated.

According to the Seattle Police Department’s year-end crime report for 2021, the number of “shots fired” reports spiked from 437 in 2020 to 612 in 2021. The report for 2022 showed 739 “shots fired” reports.

According to The Center Square, 2023 saw a 1-percent decrease in “shots fired” reports, down to 730 last year.

The revenue trail is enough to demonstrate how this tax has failed.

SEATTLE GUN TAX REVENUE

Tax Total Year Homicides

$103,766.22 2016 20

$93,220.74 2017 27

$77,518 2018 32

$85,352 2019 36

$184,836 2020 53

$165,416 2021 43

$134,322 2022 54

$113,021.15 2023 73 (64)

Sources: City of Seattle, Seattle Police Department

In 2016, the tax brought in a disappointing $103,766. Initially, the city refused to provide the revenue aggregate, but a Public Records Act lawsuit filed by GUN WEEK resulted in the disclosure. SAF financially supported the lawsuit in King County Superior Court.

In 2017, the tax revenue fell to $93,220 and the city reported 27 murders, according to updated Seattle Police data. The following year (2018), the tax return was an even more dismal $77,518, while the homicide body count climbed to 32.

In 2019, revenue jumped up to $85,352, but homicides also rose slightly to 36 for the year.

The next year—when the country experienced the COVID-19 panic and urban rioting following the death of George Floyd in Minneapolis—Seattle collected $184,836. Gun and ammunition sales in the city spiked during the “Summer of Love” as rioting and violent protests occurred, and six blocks of the city’s Capitol Hill neighborhood were literally taken over by protesters for nearly a month. The number of homicides jumped to 53, including two in the so-called “CHOP” occupied zone.

However, in 2021, gun tax revenue declined to $165,416, and the number of slayings dipped, albeit temporarily, to 43.

In 2022, the city collected $134,322 in gun tax revenue while the number of homicides jumped to 54 for the year.

Last year, as noted above, turned truly disastrous for homicides while tax revenue continued to slide.

Gottlieb is among those who believe the tax was actually instituted to drive gun and ammunition sales and dealers out of the city as some sort of “moral victory.” If that is the case, Seattle’s plan has been a failure as well since increased homicides do not translate to any kind of victory.

Seattle is the epicenter of anti-gun politics in Washington state. Efforts by state lawmakers and city leaders to repeal the 40-year-old preemption law have repeatedly failed, and the failure of the gun tax to produce the desired results appears to be something city officials will not discuss.

The only predictions that have materialized are those of the gun tax critics.

About Dave Workman

Dave Workman is a senior editor at TheGunMag.com and Liberty Park Press, author of multiple books on the Right to Keep & Bear Arms, and formerly an NRA-certified firearms instructor.

The idiots trying to push this tax state wide are delusional to think people will not just go to Idaho or a neighboring states to purchase ammo at discount prices . FJB and all Democrats.

I live 4.5 hour drive from Seattle… I use to love hitting the downtown bars in Pioneer Square when I was in my early 20’s. now days, geeze, Washington has turned into a cesspool of liberal filth.

Oddly, I have a Cowlitz Co CWP, even though I live in Oregon.. Where, one of the challenges to the states attack against gun shop owners is taking place. Great folks there at Cowlitz Co Sheriff’s office. My hat is off to them.

Since when has anything a prog ever said come true? They live in a world untouched by reality. If they would just tax every criminal $1 they would make more money than they are.

Anyone could have figured out in the beginning with half a brain that people would buy ammo and guns in different counties to avoid the tax. My understanding is now they are in the process of trying to push the same tax for the entire state and not allow internet sales without an FFL. Good luck with that washington. Kommiefornia is having problems with tax and having to buy ammo through an FFL right now because it was found unconstitutional. I know you are like Oregoneistan, NY and other blue commie states but eventually you will learn. Bruen rules. What… Read more »

REQUIRED firearm safety classes starting in elementary school would go a long way towards decreasing accidental (and likely incidental) firearm deaths. But the left won’t even let kids have nerf guns anymore.

Progressive thinking is a more sophisticated form of magical thinking. Invent premises and wish away adverse consequences. Seattle is an epicenter of a very special brand of this thought, the Frankfurt School derived New Left Progressive thought. This is magical thinking at the speed of light. That being said, those advocating taxes and restrictions do not care about consequences. They care about their feelings and the feelings of their constituents. They can simply shout down anyone who points out the anti-progress created by their policies. Facts don’t matter. Feelings matter. That is why formerly great cities like Seattle, Portland, San… Read more »

I live in the Chicagoland area. Here is how the Tax on guns and ammo work here. First the are no Gun stores in Chicago proper. The shops that exist (Very few maybe 10) in Cook County are on the edges of the county. No one is buying ammo at these places anymore. How could I justify paying 22 cents a round for 9mm and then adding 25 cents a round tax. So what do I do? I go to a shop just over the county line and buy the ammo there in bulk. Net affect you hurt the small… Read more »

When was the last time a progressive government repealled any tax?

Okay, so any time one of these (stupid) laws is enacted simply get the Republican side to insist adding languageinto that law that if results are not found within three years, it is , ‘sunset’ automatically and null and void. Simply stating that if the dem’s are so sure that the law will have results, they should not mind the additional language.

Seattle raised the hourly minimum wage of delivery drivers to over $20 an hour. Sandwich deliveries now cost $32 or more.

Door Dash has seen 30,000 FEWER orders in just two weeks, and drivers are now earning less than HALF of what they did before.

Politicians in Seattle can’t even be trusted with finger paints, much less crayons..

https://www.king5.com/article/money/food-delivery-fee-angering-seattle-app-users/281-45019904-27a4-4e9a-9cd1-b7ee4bbdb9b8